A small business seeking a suitable payment solution tailored to its financial needs must carefully consider the costs involved. In assessing payment processors like Square and PayPal, it’s essential to delve deep into their pricing models to make an informed decision that aligns with the business’s budgetary requirements. By taking a closer look at the fee structures and transaction charges of these payment gateways, businesses can unravel the intricacies of their financial implications and determine which option best suits their specific circumstances.

What is Paypal?

Founded in 1998, PayPal has positioned itself as a leading online payment solution that supports more than 100 currencies, making it a versatile choice for businesses worldwide. Beyond its primary services, PayPal also oversees various financial entities like Venmo, Xoom, and Braintree, showcasing its expansive reach and commitment to financial inclusivity.

One of PayPal’s key strengths lies in its role as a secure intermediary for businesses, ensuring the safe and protected transfer of funds without compromising sensitive banking details. Whether users access PayPal through its web platform, dedicated mobile app, or in-person using point-of-sale (POS) hardware, the platform consistently upholds its reputation as a trusted and secure facilitator of financial transactions.

What is Square?

Square’s array of services caters to small businesses with a range of software and hardware options, such as their point-of-sale system, payment processing solutions, payroll management, customer engagement tools, and employee administration services. This comprehensive approach extends to offering banking services and access to small-business loans, providing a one-stop solution for many business needs.

Businesses have the flexibility to tailor their experience with Square by choosing specific products that align with their requirements. While leveraging multiple Square products can streamline operations within its ecosystem, the standalone POS system remains a robust and fully functional option for those seeking a simpler setup. The pricing structure at Square is known for being competitive, transparent, and free from long-term contractual commitments, which adds to its appeal for small businesses.

Let’s shift our focus to a detailed analysis of the pricing strategies employed by Square and PayPal, shedding light on how these platforms approach fees for transactions and services rendered.

Pricing Plans

PayPal Fees

PayPal POS pricing/transaction fee: 2.7% to 3.5% + $0.15

Hardware price range: $14.99 to $99.99

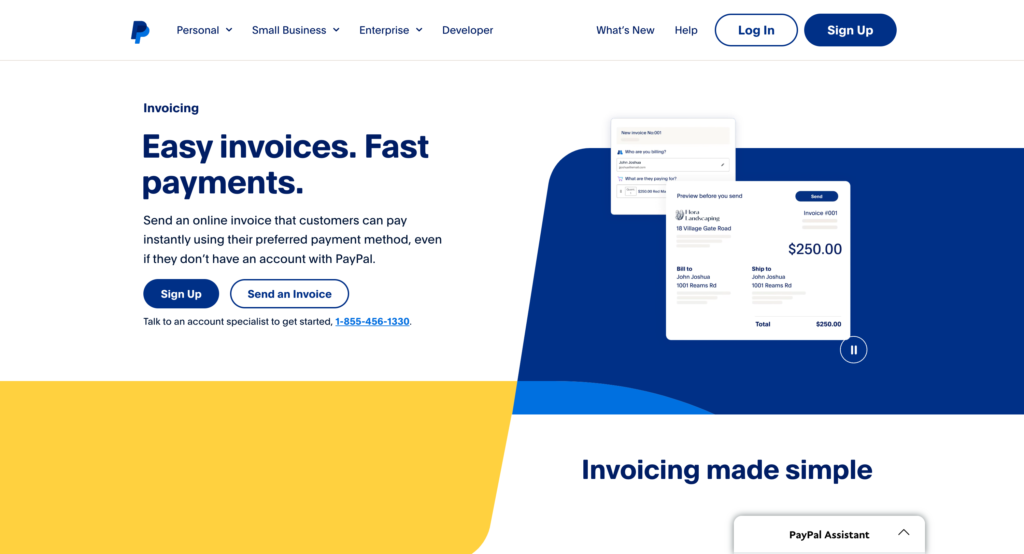

PayPal offers various fee structures depending on the service used. For instance, PayPal typically charges a fee of about 2.9% of the transaction value plus $0.30 for each successful payment processed through their services, such as PayPal Checkout and PayPal Payments. However, PayPal Payments Pro deviates from this standard model by adding a fixed monthly charge of $30 on top of the regular processing fee of 2.9% + $0.30 per transaction.

When it comes to transactions through PayPal Here using a card reader, a slightly lower rate of 2.7% of the transaction amount is applied. On the other hand, keyed-in payments through PayPal Here incur a higher fee of 3.5% of the transaction value along with an additional $0.15 per transaction.

Additionally, PayPal Invoicing users face a processing fee of 2.9% plus a $0.30 charge. These charges are for card payments made by customers when settling their invoices through PayPal’s invoicing platform.

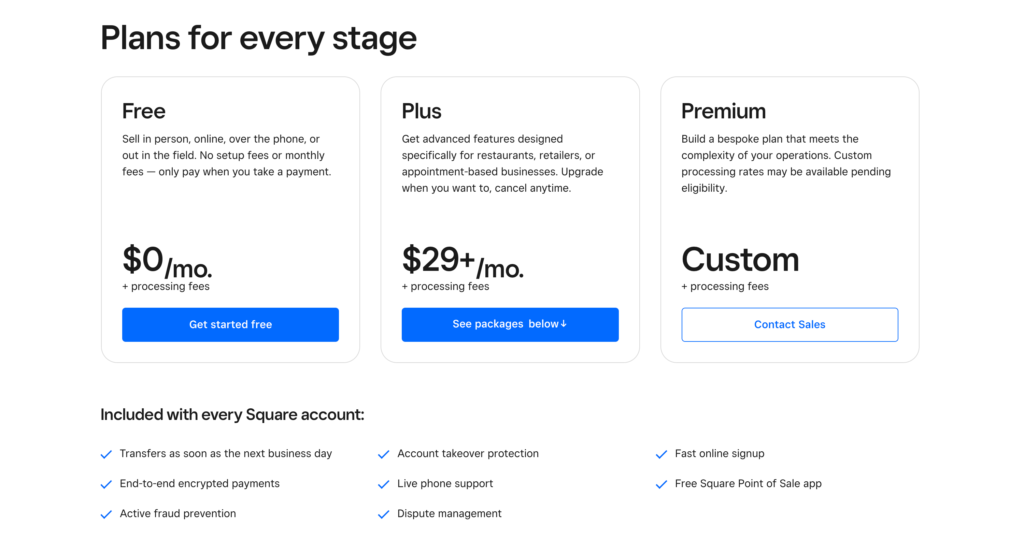

Square Fees

Square pricing/transaction fee: 2.5% + $0.10 to 3.5% + $0.15

POS Hardware pricing: Free, until processing amount of $799

Square offers a wide array of payment solutions, which can make its pricing model seem complex. The fees charged by Square differ depending on the specific product being used. For Square’s POS systems, transaction fees range from 2.6% plus $0.10 to 3.5% plus $0.15, depending on the POS hardware employed.

When businesses utilize Square’s headphone jack or Bluetooth reader for processing card payments, they incur a fee of 2.6% plus $0.10 per transaction. In the case of using the Square Stand for card payment processing, the fee remains at 2.6% plus $0.10 per transaction. Similarly, if card payments are processed via the Square Terminal or Square Register, the fee charged is also 2.6% plus $0.10 per transaction.

In addition to its payment processing fees, Square provides basic software for free with the Square point of sale system. However, choosing the Square for Retail app may result in monthly fees ranging from $0 to $299, depending on the selected plan. This variety in pricing options allows businesses to tailor their payment solution to their specific needs and budget constraints. Square’s flexibility in pricing and product offerings caters to businesses of various sizes and complexities.

In-person transactions fee: 2.6% + $0.10

In-app transactions fee: 2.9% + $0.30

Online transactions fee: 2.9% + $0.30

Features

Square

Square offers an intuitive online payment platform with versatile remote payment capabilities. Users can swiftly send invoices and enable customers to pay through various methods like ACH, debit, and credit cards. Additionally, Square facilitates phone payments and offers website creation tools. They provide a distinctive square-shaped mobile payment device and multiple POS solutions.

PayPal

PayPal offers a range of developer tools tailored for seamless integration of payment buttons on websites. These tools emphasize invoicing features and the capacity to establish recurring billing. Furthermore, PayPal accounts include complimentary chip and swipe card readers as well as chip and tap devices for in-person contactless transactions. However, a significant limitation of PayPal is its lack of POS hardware, necessitating dependence on external vendors.

Customer Service

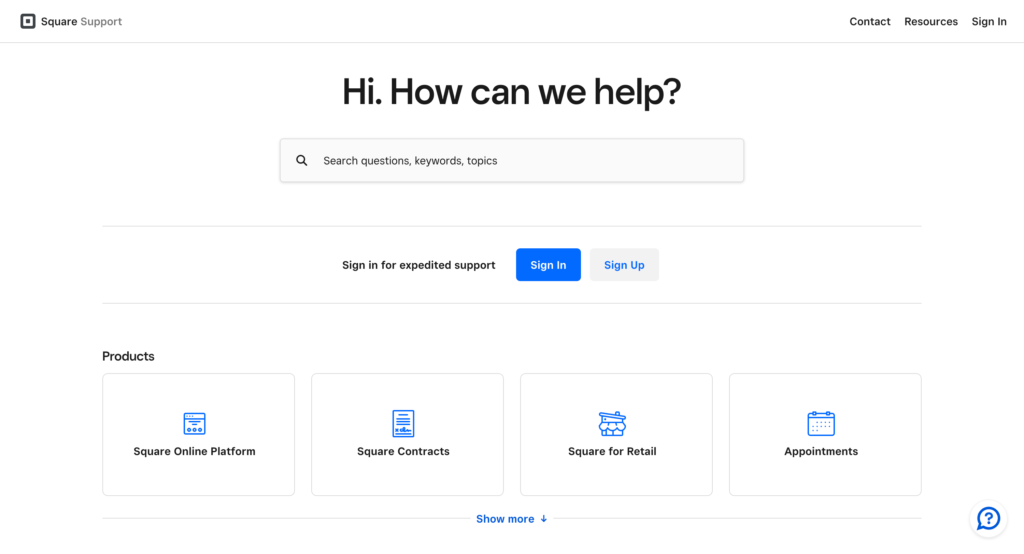

Square Customer Service

Square stands out for providing a comprehensive array of customer support options tailored to meet diverse user preferences. Users can reach out to Square’s support team through multiple channels, such as phone, email, and live chat. This multichannel approach includes interactions with virtual assistants and live human representatives, ensuring that users can choose the most convenient mode of communication. Also, Square emphasizes connectivity through social media platforms, enhancing accessibility for users who prefer to engage through social channels.

However, one aspect that users may find limiting is the availability of live support. Square restricts live support to Monday through Friday, from 6 a.m. to 6 p.m. Pacific Time. While this timeframe caters well to typical business hours, it may present challenges for users requiring assistance outside of these designated times.

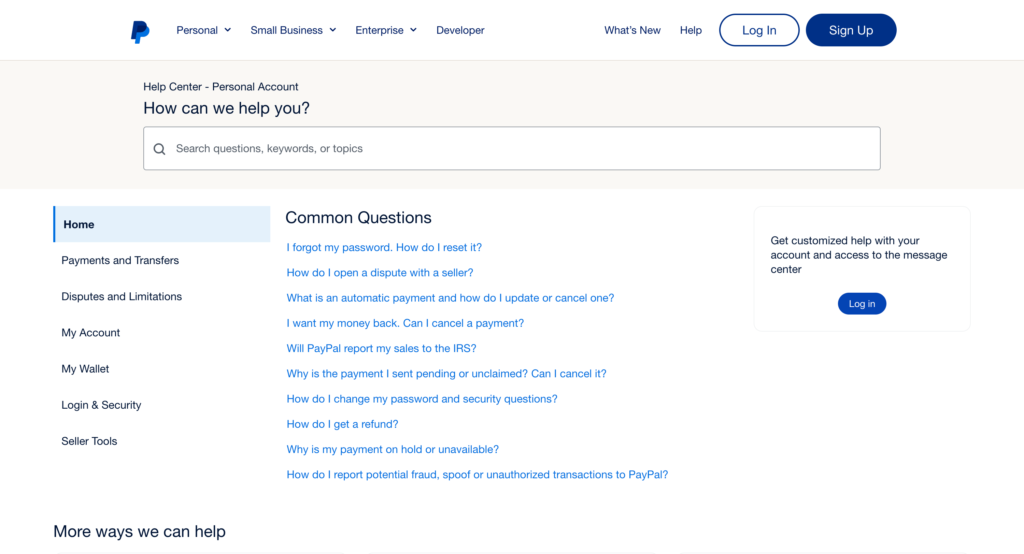

PayPal Customer Service

PayPal sets itself apart through its comprehensive customer support options, offering users access to phone support, instant messaging, and the resolution center for quick issue resolution. Moreover, businesses can tap into the collective knowledge of the PayPal community through active participation in community forums. Customer service agents are easily accessible seven days a week, extending their assistance from 6 a.m. to 6 p.m. Pacific Time.

Integrations

Square

Square stands out in the realm of decoding payment solutions not just for its seamless transactions but also for its extensive range of online integrations, all conveniently accessible through the Square App Marketplace. This diverse array of integrations goes beyond the basics, connecting users to essential services like QuickBooks, ZipRecruiter, and Xero, making Square a versatile choice for businesses seeking a holistic payment processing solution.

PayPal

PayPal’s integrations are strategically implemented across a wide range of third-party POS terminals and platforms, offering a slightly different approach compared to Square. Despite having fewer direct integrations with third-party apps than Square, PayPal stands out for its seamless compatibility with major platforms like eBay, QuickBooks, and Shopify. The versatility of PayPal’s integration capabilities ensures that businesses can effectively streamline their payment processes and cater to a broader customer base through well-established platforms.

0 Comments